Understanding Financial Services

Financial services encompass a wide range of offerings designed to help individuals and businesses manage their money better. From financial planning to investment advice, these services play a crucial role in improving financial health. In today’s fast-paced world, understanding and utilizing financial services is more essential than ever for achieving your financial goals.

Key Areas of Financial Services

Financial Planning

Financial planning is the process of creating a roadmap for reaching your financial goals. A financial advisor can help you analyze your current situation, set realistic financial goals, and develop strategies to achieve them. Key components often include budgeting, savings strategies, and investment planning.

- Create a Budget: Track your income and expenses to identify areas for improvement.

- Set Financial Goals: Outline short-term and long-term objectives, like saving for a house or retirement funds.

- Emergency Fund: Maintain a savings buffer to cover unexpected expenses.

Investment Advice

Investing wisely is crucial for building wealth over time. With proper investment strategies, you can grow your assets, increase savings, and prepare for future expenses. A financial consultant can provide tailored investment advice based on your financial goals.

- Types of Investments: Stocks, bonds, mutual funds, ETFs, and real estate.

- Risk Assessment: Understand your risk tolerance and create a diversified portfolio accordingly.

- Long-term vs. Short-term Investments: Balance your investment strategy based on your timeline for achieving specific goals.

Wealth Management

Wealth management is a comprehensive approach towards managing an individual’s or family’s assets. It combines investment management, tax planning, and estate planning to ensure long-term financial health.

- Personalized Strategies: Tailor wealth management strategies based on individual needs.

- Investment Management: Continuously monitor and adjust investments to maximize returns.

- Estate Planning: Ensure your assets are distributed according to your wishes after your passing.

Retirement Planning

Planning for retirement is crucial, especially for ensuring financial stability in your later years. Understanding retirement funds, like 401(k)s or IRAs, can significantly influence your savings strategy.

- Set Retirement Goals: Determine the lifestyle and expenses you expect in retirement.

- Regular Contributions: Contributing consistently to retirement accounts helps grow your savings over time.

- Review Investment Options: Explore different retirement investment strategies to optimize your retirement funds.

Tax Planning

Effective tax planning can help maximize your income and minimize your taxable liabilities. It involves strategic decisions regarding investments, charity donations, and retirement contributions.

- Understand Tax Brackets: Know which tax bracket applies to your income and how investments can mitigate it.

- Tax-advantaged Accounts: Utilize accounts like Roth IRAs or HSAs for potential tax benefits.

- Tax Deductions and Credits: Keep track of potential deductions and credits available to you.

Insurance Solutions

Insurance is an essential part of financial stability, protecting you from unexpected financial burdens. Understanding various insurance solutions can help safeguard your wealth.

- Life Insurance: Provides financial support to your loved ones in case of untimely demise.

- Health Insurance: Covers medical expenses and protects against high healthcare costs.

- Property Insurance: Protects your assets from damages or loss.

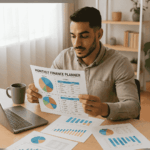

Benefits of Financial Services

Utilizing financial services can offer numerous advantages, enhancing both personal and corporate financial health.

- Expert Guidance: Financial advisors provide insights based on experience and research.

- Customized Solutions: Tailored financial strategies can meet your unique needs.

- Peace of Mind: Knowing that an expert is managing your finances can reduce stress and provide confidence in your financial decisions.

Choosing the Right Financial Service Provider

Selecting the right financial service provider can be pivotal in achieving your financial goals. Here are some factors to consider:

- Qualifications and Experience: Ensure the provider has the necessary credentials and a proven track record.

- Personalized Approach: Look for advisors who take the time to understand your personal situation and tailor their services accordingly.

- Transparent Fees: Be clear about the fee structures and any hidden costs associated with their services.

Questions to Ask

- What services do you offer?

- How do you charge for your services?

- Can you provide references from past clients?

Final Thoughts

In conclusion, financial services can empower you to take control of your personal and business finances, allowing you to work towards stability and growth. Whether you’re seeking financial planning, investment advice, or wealth management, understanding these services is essential for achieving your financial goals. Engage with a financial advisor or consultant to discuss your unique situation and benefits that may work best for you. By taking proactive steps, you can secure a healthier financial future.