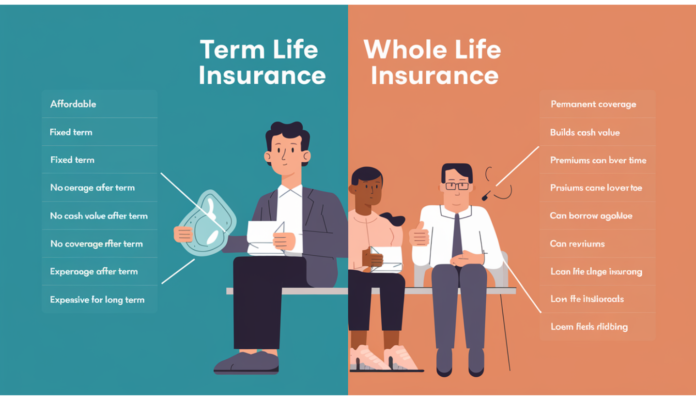

When it comes to life insurance, two of the most popular options are term and whole life insurance. Both serve the essential purpose of providing financial security to your loved ones, but they work differently, offer distinct benefits, and vary in cost. In this guide, we’ll dive deep into the differences between term and whole life insurance, helping you decide which policy aligns best with your financial goals.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. During this time, the policyholder pays a set premium, and if they pass away within this term, their beneficiaries receive the policy’s death benefit. Term life insurance is popular because it is straightforward, generally less expensive, and meets temporary financial needs.

Key Features of Term Life Insurance

- Affordable Premiums

Since term life insurance only covers a fixed period, premiums are usually lower compared to whole life insurance. This makes it a cost-effective option for individuals or families on a budget. - Coverage for Temporary Needs

Term life insurance is ideal for covering specific financial obligations that have an end date, such as mortgage payments, children’s college expenses, or personal debts. - No Cash Value

Unlike whole life insurance, term life does not accumulate cash value. Once the term ends, the coverage ends, and there is no payout if the policyholder is still alive.

Pros and Cons of Term Life Insurance

- Pros:

- Lower premiums compared to whole life

- Suitable for temporary needs

- Simple to understand

- Cons:

- No cash value accumulation

- Coverage ends after the term expires

- May need to renew or convert to maintain coverage

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that covers the policyholder for their entire life, provided they continue paying premiums. It includes a death benefit and a cash value component, which can grow over time and even be borrowed against.

Key Features of Whole Life Insurance

- Lifelong Coverage

Whole life insurance provides guaranteed coverage as long as premiums are paid, making it ideal for those seeking lifelong financial protection for their family. - Cash Value Accumulation

A portion of each premium goes toward building a cash value. Over time, this cash value grows at a guaranteed rate and can be used as a loan or for other purposes, though loans reduce the death benefit if unpaid. - Stable Premiums

Whole life premiums remain fixed throughout the policyholder’s life. Although whole life insurance is generally more expensive, the stable premiums provide predictability in long-term financial planning.

Pros and Cons of Whole Life Insurance

- Pros:

- Lifelong coverage

- Cash value growth and borrowing options

- Fixed premiums

- Cons:

- Higher premiums compared to term life

- Less flexibility for short-term needs

- Cash value growth can be slow

Key Differences Between Term and Whole Life Insurance

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | 10, 20, or 30 years | Lifetime |

| Premiums | Lower and fixed for term duration | Higher and fixed for life |

| Cash Value | No cash value | Builds cash value over time |

| Ideal For | Temporary financial obligations | Long-term financial protection and savings |

| Flexibility | Less flexible after term ends | Cash value can be borrowed or withdrawn |

Choosing Between Term and Whole Life Insurance

The decision between term and whole life insurance depends largely on your financial goals, budget, and the type of protection you need. Here are some factors to consider:

- Budget

If you’re on a tight budget but want to provide substantial financial security, term life may be the right choice. It provides high coverage at a low cost, especially for younger individuals. - Long-Term Needs

For those seeking a lifelong financial safety net, particularly for estate planning, whole life insurance can be an asset. It not only offers permanent coverage but also builds a cash reserve that can be accessed for emergencies or retirement. - Financial Goals

Term life insurance works well for temporary needs, such as covering a mortgage or ensuring children’s education funding. Whole life insurance, on the other hand, can help with broader goals, including inheritance planning or leaving a legacy for loved ones. - Risk Tolerance

While whole life insurance offers cash value that grows over time, other permanent policies, such as variable or universal life insurance, may offer investment options but come with higher risks. If you prefer predictability, traditional whole life insurance is a better choice.

Can You Convert Term Life to Whole Life Insurance?

Some term policies offer a conversion option, allowing policyholders to convert term insurance into whole life insurance within a specified period. This is beneficial for those who start with term life but later decide they want lifelong coverage. However, the premiums will increase when converting, as whole life policies are more expensive.

Is It Possible to Have Both Term and Whole Life Insurance?

Yes, it’s possible—and sometimes recommended—to combine both types of policies. Known as a life insurance ladder, this strategy involves purchasing multiple term policies with different durations and one whole life policy. For example, you may buy a 20-year term policy to cover your mortgage, a 10-year term policy for your child’s education, and a whole life policy for long-term needs.

When Does It Make Sense to Choose Term Over Whole Life Insurance?

- Limited Budget: Term insurance is more affordable, making it ideal for those needing high coverage with limited funds.

- Temporary Coverage Needs: If you want coverage during high-expense years, such as while paying off debt or until children are independent, term insurance may suffice.

- Focus on Short-Term Goals: If you prioritize short-term protection over long-term savings, term life is often a better choice.

When Whole Life Insurance Might Be the Right Choice

- Seeking Permanent Protection: If your main goal is lifelong financial security, a whole life policy provides lasting benefits.

- Cash Value Benefits: Whole life insurance accumulates cash value, which can be a financial asset for emergencies or retirement.

- Legacy or Estate Planning: Whole life is an effective tool for leaving an inheritance or planning for estate taxes.

Conclusion: Finding the Right Fit

Choosing between term and whole life insurance depends on your financial goals, risk tolerance, and budget. For some, term life provides an affordable way to secure financial protection during critical years. For others, whole life insurance offers peace of mind with permanent coverage and the potential for cash value growth. Whichever you choose, life insurance remains a critical part of protecting your loved ones and securing their future.