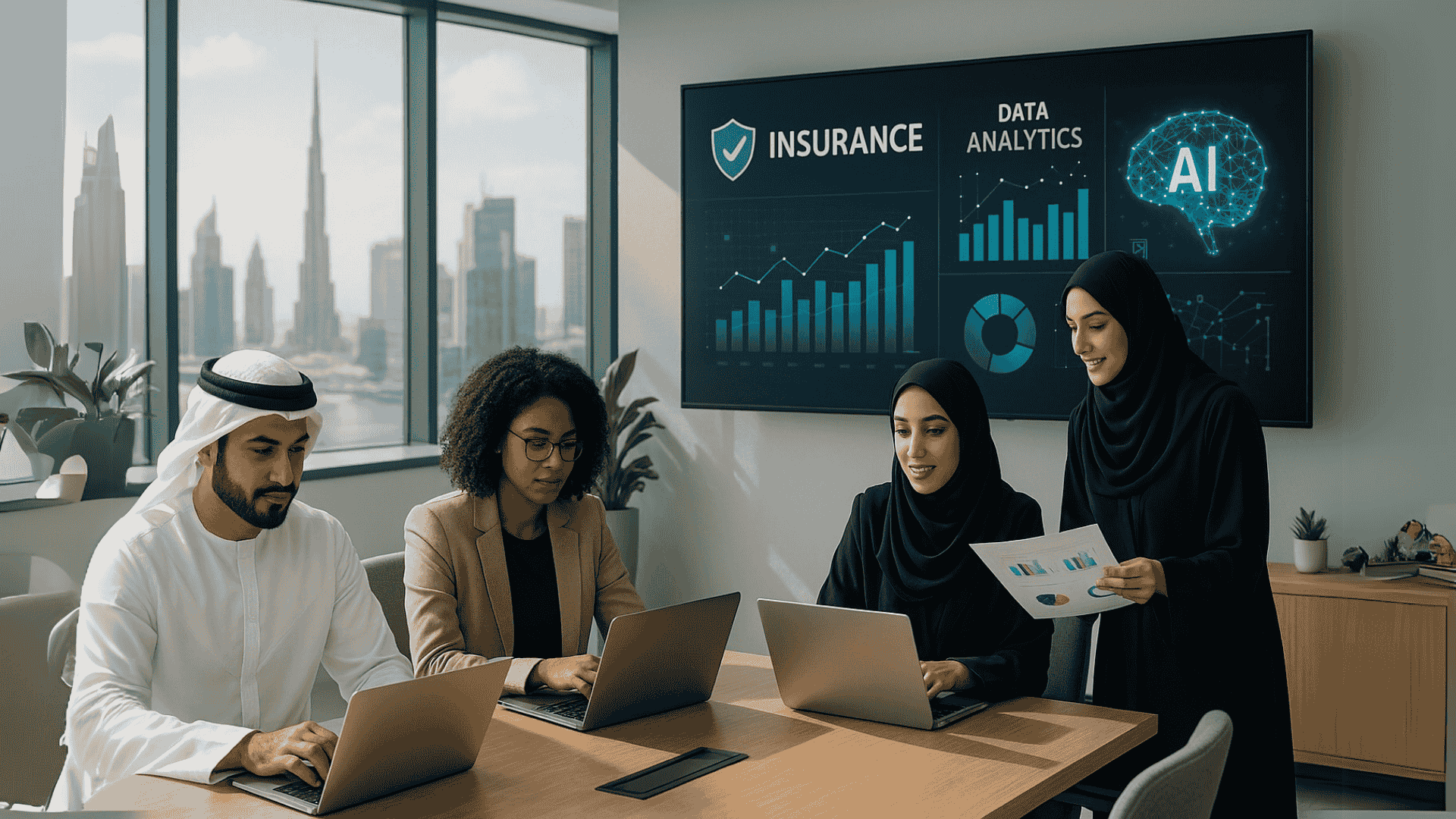

Insurance Jobs in the UAE: A Thriving Sector for Ambitious Professionals

The UAE’s insurance industry is rapidly evolving, fueled by regulatory reforms, technological disruption, and a growing demand for personalized coverage. For professionals eyeing high-paying jobs with long-term stability, insurance jobs in the UAE present a lucrative career path. Whether you’re a seasoned underwriter or a recent graduate exploring remote jobs, this dynamic sector offers an expansive range of opportunities. Why the UAE’s Insurance Sector Is Attracting Top Talent 1. Lucrative Salaries with Tax-Free Advantages One of the most compelling reasons to consider insurance jobs in the UAE is the tax-free salary structure. High-level roles across the sector command impressive monthly earnings: Senior Underwriters: AED 25,000–40,000 Insurance Data Scientists: AED 30,000–50,000 Claims Managers: AED 20,000–35,000 These packages, coupled with performance bonuses and housing allowances, make the UAE especially appealing to global professionals. 2. Career Opportunities at Every Experience Level From fresh graduates to industry veterans, the insurance field offers a wealth of roles that cater to various skill sets. Companies like ADNIC and Oman Insurance now hire for remote and hybrid jobs in: AI development for fraud detection Cybersecurity to safeguard sensitive data Digital marketing of insurance products 3. A Launchpad to International Careers The UAE serves as a regional hub, connecting professionals to global networks. Multinational firms like Allianz and Emirates Insurance Company operate across Europe, Asia, and the Middle East. As a result, top performers often receive opportunities for international assignments and rotations. Top In-Demand Insurance Roles in the UAE 1. Actuaries and Data Scientists With the emergence of insurtech, companies rely heavily on data science to manage risk. Actuaries use predictive modeling tools like Python and R, while analysts apply Tableau and Power BI to optimize pricing and policy offerings. 2. Underwriters and Risk Managers These roles are essential for evaluating policy applications and mitigating risk. Professionals need a firm grasp of regional regulations under the UAE Insurance Authority and strong analytical skills. 3. Claims Adjusters and Customer Support Claims specialists are the backbone of any insurance firm. They investigate claims, assess liability, and negotiate settlements. Additionally, the growing demand for remote customer service jobs has created new pathways into the sector. 4. Sales and Digital Marketing Experts With digital channels dominating client acquisition, there’s rising demand for professionals who can market policies online, build partnerships with banks, and manage social media campaigns. 5. Compliance and Regulatory Professionals Stricter compliance requirements around data privacy and AML (Anti-Money Laundering) laws have increased the need for skilled compliance officers. These experts ensure that companies meet all legal standards. Skills That Set You Apart in Insurance Jobs Technical Skills: Data analytics (SQL, Python, Power BI) Underwriting platforms (Guidewire, SAS) CRM tools (Salesforce, Zoho) Soft Skills: Conflict resolution and negotiation Cross-cultural communication skills Adaptability to digital tools and remote work setups How to Enter the UAE Insurance Job Market 1. Use Top Job Platforms and Agencies Start with trusted platforms like LinkedIn and Indeed to access thousands of listings. For specialized positions, agencies like Hays and Michael Page can help you connect with premium employers such as National General Insurance. 2. Apply to Leading Insurance Firms ADNIC: Known for innovation in health and marine insurance. Oman Insurance: A market leader in motor and travel insurance. Allianz: Offers remote roles in claims and tech support. 3. Upskill with Emerging Trends Blockchain: Gain an understanding of smart contracts. ESG Risk Management: Take short courses on sustainability and risk profiling. Insurtech: Learn how AI, IoT, and automation impact the sector. Emerging Trends Shaping Insurance Careers 1. AI and Automation With 40% of customer queries now handled by AI-powered chatbots, developers and machine learning specialists are in high demand. 2. Remote Work Normalization Approximately 30% of insurers in the UAE offer remote jobs, especially in roles such as virtual claims adjusting and online customer onboarding. 3. Personalized Insurance Products Thanks to wearables and IoT, insurers offer tailored policies. This trend has boosted the demand for data scientists and IoT analysts. 4. Green Insurance and Sustainability As the UAE targets net-zero emissions by 2050, companies like Orient Insurance are pioneering green coverage options for solar projects. This is creating new project manager jobs in sustainability and climate risk. How Insurance Jobs Compare to Other Sectors in the UAE Unlike sectors like oil & gas or hospitality, the insurance industry offers: Greater Stability: Less exposed to economic cycle Faster Career Growth: Clearer promotion paths Better Work-Life Balance: More predictable hours than consulting or legal professions Common Challenges and How to Overcome Them 1. High Competition Stand out by: Earning certifications like ACII or CPCU Attending events like the Dubai InsurTech Summit Showcasing quantifiable achievements on your LinkedIn 2. Regulatory Complexity Stay updated through monthly Insurance Authority bulletins and enroll in CPD courses related to compliance. 3. Navigating Cultural Nuances Success in client-facing roles depends on understanding local business etiquette—such as relationship building and respecting hierarchy. Final Thoughts: Why Insurance Jobs in the UAE Are Worth Exploring Insurance jobs in the UAE are more than just high-paying—they offer a fusion of stability, global exposure, and technological advancement. From AI developers to underwriting leaders, the sector is ripe with opportunity for those who adapt and upskill. So, whether you’re exploring careers in finance, tech, or sales, consider the insurance sector as a long-term, future-proof option. Update your resume, highlight key achievements, and position yourself in one of the UAE’s most forward-thinking industries. Looking for more immediate hiring opportunities in Dubai? Click here to browse more UAE job vacancies. Click Here Explore job listings on Indeed for more opportunities in customer service, where you can find a variety of roles tailored to your skills. Visit Linkedin Jobs for networking and job opportunities in the UAE, connecting you with professionals in your field. Check Gulf Talent for additional job openings and career advice, ensuring you stay informed about the latest trends in the job market.