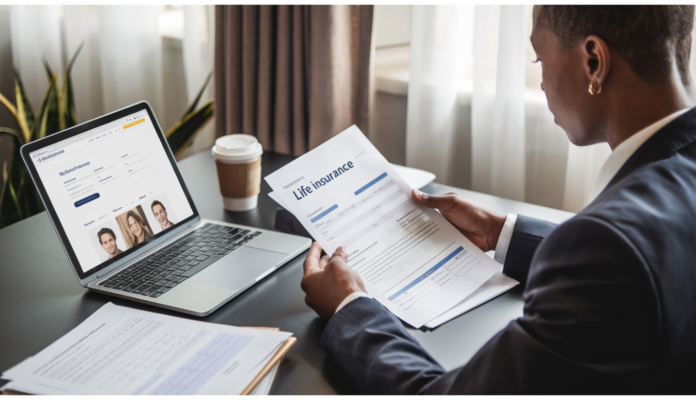

The Role of Life Insurance in Retirement Planning

Retirement planning is about ensuring financial stability and peace of mind for your golden years. Many people think of life insurance as solely a means of income replacement, but it can be a crucial part of a well-rounded retirement strategy. Whether you’re planning for future healthcare expenses, preserving assets for loved ones, or securing an income stream, life insurance offers versatile benefits for retirees. Let’s explore how life insurance can contribute to a secure and prosperous retirement.

Why Include Life Insurance in Retirement Planning?

When preparing for retirement, most people focus on their savings, investments, and Social Security benefits. While these are critical, life insurance can complement these assets in several ways. From protecting your wealth to providing tax benefits and covering unforeseen expenses, life insurance can be a valuable addition to your retirement portfolio.

Benefits of Life Insurance in Retirement Planning

- Asset Protection and Estate Planning

Life insurance allows retirees to pass on wealth to their heirs without probate delays or estate taxes, making it an effective tool for estate planning. Whole and universal life policies, which accumulate cash value, can also shield beneficiaries from future expenses. - Tax-Deferred Growth and Withdrawals

Life insurance offers tax-deferred cash value accumulation, which grows without immediate tax liabilities. This feature makes it a beneficial asset for wealth-building, allowing retirees to withdraw or borrow against the cash value when needed. - Income Replacement for Spouses

Life insurance helps protect a spouse’s financial security, especially if they rely on the policyholder’s retirement income. With a life insurance policy in place, surviving spouses can continue their lifestyle without the financial strain of losing one income source. - Flexibility for Emergencies or Health Expenses

Health expenses tend to increase with age. Life insurance with a cash value component can provide an emergency fund for unexpected medical costs, long-term care, or other unexpected expenses that might arise in retirement.

Types of Life Insurance Policies Beneficial for Retirement

Not all life insurance policies are equally beneficial for retirees. Below are some options to consider for your retirement planning:

1. Whole Life Insurance

Whole life insurance offers lifelong coverage, and part of the premium goes toward building cash value. This cash value grows at a fixed interest rate and can be borrowed against. This type of policy provides both death benefits and a reserve that can serve as an emergency fund in retirement.

2. Universal Life Insurance

Universal life insurance offers flexibility in both premium payments and death benefits. Additionally, it accumulates cash value based on market interest rates, allowing for potentially higher returns. Retirees can access cash value to supplement their income, adding flexibility to their retirement funds.

3. Variable Life Insurance

For those who are more investment-savvy and willing to take on risk, variable life insurance provides cash value growth tied to market investments. While riskier, this policy can yield higher returns, making it suitable for retirees with a diversified portfolio who are comfortable with market fluctuations.

4. Term Life Insurance for Specific Needs

While term life insurance does not build cash value, it can provide temporary coverage if you have specific, time-limited financial obligations or dependents. Term life policies can be a cost-effective solution if you need coverage only for a certain period during retirement.

How Life Insurance Enhances Financial Security in Retirement

1. Supplementing Retirement Income

Many whole and universal life insurance policies have cash value components that can act as a secondary income source. By withdrawing or borrowing against this cash value, retirees can supplement their income without dipping into other retirement savings, such as IRAs or 401(k)s.

2. Protecting Retirement Savings for Loved Ones

Life insurance allows retirees to protect their assets while still meeting financial goals. The death benefit can act as an inheritance for heirs, allowing you to spend more freely in retirement without fearing that you will leave your loved ones with nothing.

3. Addressing Long-Term Care Costs

Some life insurance policies offer long-term care riders, which provide funds for nursing home or home healthcare if the policyholder becomes unable to care for themselves. This is a practical and often more affordable alternative to purchasing a separate long-term care insurance policy.

4. Minimizing Tax Liabilities

Unlike traditional retirement accounts that are taxed upon withdrawal, the cash value in a life insurance policy grows tax-deferred. Beneficiaries also receive death benefits tax-free, making life insurance a valuable tool for tax-efficient retirement planning.

Case Study: Using Life Insurance as a Retirement Tool

Consider Mark and Susan, a couple nearing retirement. They have saved diligently but are concerned about how unforeseen medical expenses and estate taxes might affect their retirement. To address these concerns, they decide to purchase a whole life insurance policy.

This policy offers both a death benefit for their heirs and an accessible cash value that they can use as a supplemental income source. Over time, they can borrow against this cash value to cover any unexpected health expenses. Additionally, they know that their beneficiaries will receive a tax-free death benefit, helping them preserve their legacy without a heavy tax burden.

How Much Life Insurance Do You Need for Retirement?

When determining how much life insurance to include in your retirement plan, consider factors such as:

- Income Replacement Needs: How much would your spouse or dependents need to maintain their lifestyle without your income?

- Medical and Long-Term Care Costs: Estimate future healthcare expenses and consider a policy with a long-term care rider if you lack other coverage.

- Legacy Goals: Think about the inheritance or charitable contributions you’d like to leave behind.

- Tax Considerations: Understand how life insurance can minimize estate taxes for your beneficiaries.

While needs vary, a financial advisor can help you calculate the optimal amount of coverage based on these and other factors.

Tips for Retirees Choosing Life Insurance

- Start Early

Life insurance premiums are typically lower the younger and healthier you are, so it’s best to start considering it as early as possible. - Assess Your Health

Some life insurance policies, especially those with long-term care benefits, may require health screenings. Assessing your health status can guide you toward a policy that meets both your current and future needs. - Consider Convertible Policies

Some term policies offer the option to convert to whole or universal life insurance, providing flexibility if your needs change. - Work with a Financial Advisor

A certified financial advisor with expertise in retirement planning can help you choose the right life insurance policy that aligns with your retirement goals and financial status.

Conclusion: Building a Secure Retirement with Life Insurance

Life insurance is a versatile tool that can contribute to a comfortable and financially secure retirement. Beyond providing a death benefit, it can serve as a supplemental income source, tax-advantaged savings vehicle, and protection against unexpected expenses. By incorporating life insurance into your retirement plan, you create a safety net that helps protect your loved ones, meet your financial goals, and provide peace of mind during your golden years.