Two individuals in my household who’re impartial contractors and lack employer medical insurance occur to be turning 65 this yr and can lastly be eligible for Medicare. Hallelujah!

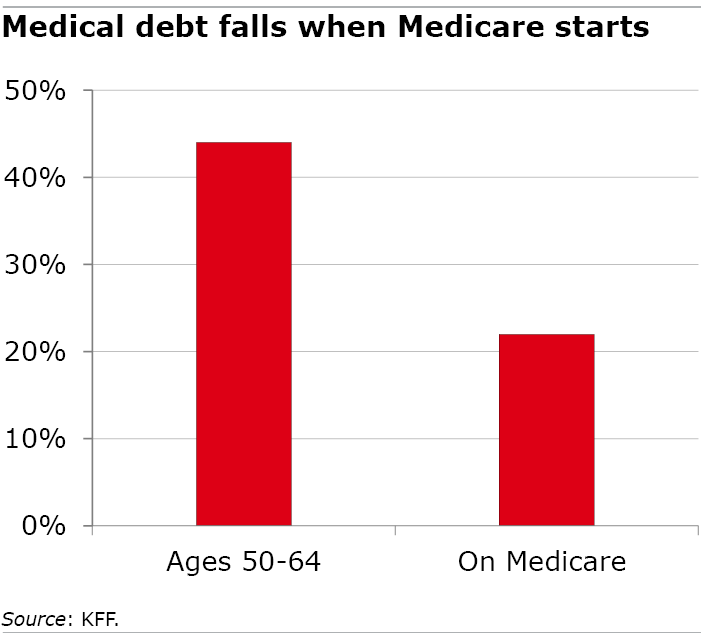

A report by KFF, the well being care analysis and information group, exhibits why Medicare eligibility is a milestone: 22 % of individuals over 65 are paying off debt incurred for routine medical assessments, medical doctors and dental care. Whereas that’s rather a lot, it’s half as a lot because the share of older staff paying off medical debt.

A report by KFF, the well being care analysis and information group, exhibits why Medicare eligibility is a milestone: 22 % of individuals over 65 are paying off debt incurred for routine medical assessments, medical doctors and dental care. Whereas that’s rather a lot, it’s half as a lot because the share of older staff paying off medical debt.

Retirees are considerably protected against piling up debt for 2 causes, mentioned Alex Cottrill, a KFF coverage analyst. Medicare protection is almost common, and retirees often have an Benefit Plan, Medigap, Medicaid, or a former employer’s retiree medical insurance to assist with cost-sharing bills or to pay for providers that conventional Medicare doesn’t cowl.

Distinction retirees’ near-universal protection with working-age individuals. Roughly 10 % go with none medical insurance – together with one particular person in my household who will flip 65 – placing themselves susceptible to massive out-of-pocket bills in the event that they change into unwell. My different member of the family turning 65 has been shopping for a coverage on the Reasonably priced Care Act’s (ACA) state change with a $7,000 deductible. The deductibles and premiums for ACA insurance policies for a typical employee eat almost 12 % of their earnings. Even amongst private-sector staff with employer protection, half are in high-deductible plans that incur massive bills earlier than insurance coverage begins paying.

Relying on the character of their sickness or the kind of protection, retirees may have excessive out-of-pocket bills, leading to one in 5 having medical debt. That could be a drawback in a inhabitants in declining well being with modest financial savings during which half have incomes beneath $36,000, Cottrill mentioned. Medicare is “sturdy insurance coverage however usually they don’t have a number of monetary sources accessible to them in the event that they’re hit with a medical invoice they weren’t anticipating,” he added.

When older Individuals can’t afford care, they endanger their well being. In KFF’s survey, 62 % of retirees with medical debt delayed or skipped care. These retirees are making a monetary choice, fairly than the very best choice for his or her well being.

Medicare, which handed in 1965, stays a landmark program. However there are nonetheless too many retirees who wrestle to pay for care.

Squared Away author Kim Blanton invitations you to observe us @SquaredAwayBC on X, previously often known as Twitter. To remain present on our weblog, be part of our free e-mail checklist. You’ll obtain only one e-mail every week – with hyperlinks to the 2 new posts for that week – once you enroll right here. This weblog is supported by the Middle for Retirement Analysis at Boston Faculty.