By William Nibbelin, Senior Analysis Actuary, Triple-I

Insurance coverage is priced to mirror the underlying danger of each coverage. When extra claims are filed and the typical quantity paid of these claims will increase, insurance coverage turns into dearer. A measure of underwriting profitability for insurance coverage carriers is the mixed ratio calculated as losses and expense divided by earned premium plus working bills divided by written premium. A mixed ratio over 100 represents an underwriting loss. When anticipated losses improve, an insurance coverage service should improve premiums by elevating charges to take care of a mixed ratio beneath 100.

Industrial auto insurance coverage has recorded a web mixed ratio over 100 9 occasions out of 10 between 2014 and 2023, and, in keeping with the newest forecasting report by Triple-I and Milliman, continues to worsen in 2024. In response to the Triple-I Points Temporary, private auto insurance coverage has had a web mixed ratio over 100 for the previous three years, with a 2023 web written premium (NWP) progress of 14.3 p.c, which was the very best in over 15 years.

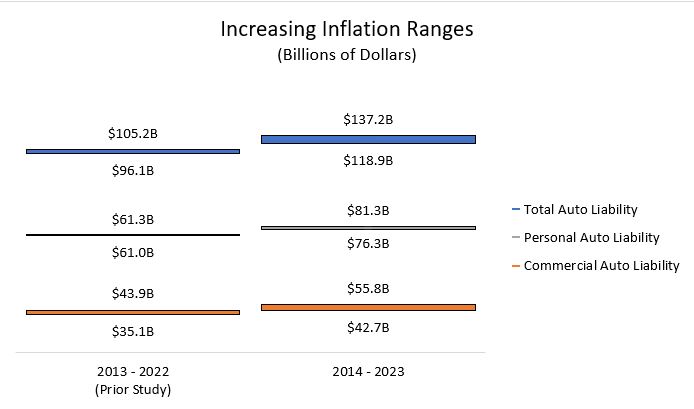

From 2014 via 2023 financial and social inflation added $118.9 billion to $137.2 billion in auto legal responsibility losses and protection and value containment (DCC) bills. This represents 9.9 p.c to 11.5 p.c of the $1.2 trillion in web losses and DCC for the interval and a rise of 24 p.c to 31 p.c from the earlier evaluation on years 2013 via 2022.

A brand new research – “Growing Inflation on Auto Legal responsibility Insurance coverage – Impression as of Yr-end 2023” – is the fourth installment of analysis on the influence of financial and social inflation on insurer prices and declare payouts. In comparison with the prior research, Industrial Auto Legal responsibility loss and DCC is 20.7 p.c to 27.0 p.c ($43 billion to $56 billion) larger resulting from rising inflation. Private auto legal responsibility loss and DCC is 7.7 p.c to eight.2 p.c ($76 billion to $81 billion) larger from rising inflation.

Key Takeaways

- The compound annual influence of accelerating inflation ranges from 2.2 p.c to 2.9 p.c for industrial auto legal responsibility, which is larger than the non-public auto legal responsibility estimate of 0.7 p.c. Nonetheless, the influence of accelerating inflation from a greenback perspective is far larger for private auto legal responsibility in comparison with industrial auto legal responsibility. That is due, partially, to the underlying dimension of the road of enterprise.

- Frequency of auto legal responsibility claims per $100 million GDP for 2023 is unchanged for industrial auto legal responsibility and decrease for private auto legal responsibility in comparison with 2020, when frequency dropped on the onset of the COVID-19 pandemic for each strains.

- Severity of auto legal responsibility claims continues to extend 12 months over 12 months and has elevated greater than 70 p.c from 2014 to 2023 for each strains.

Researchers Jim Lynch, FCAS, MAAA, Dave Moore, FCAS, MAAA, LLC, Dale Porfilio, FCAS, MAAA, Triple-I’s chief insurance coverage officer, and William Nibbelin, Triple-I’s senior analysis actuary used an analogous methodology as prior research. Loss improvement patterns have been used to establish inflation for chosen property/casualty strains in extra of inflation within the general economic system. The brand new research extends the mannequin with annual assertion information via year-end 2023.

Industrial Auto Legal responsibility

The prior research indicated declare severity (dimension of losses) had risen 72 p.c general from 2013 to 2022, with the median annual improve at 6.3 p.c. The brand new research signifies a further annual improve of 6.6 p.c from 2022 to 2023. The report compares the compound annual progress fee of 6.6 p.c from 2014 via 2023 to the compound annual improve within the client worth index (CPI) of two.8 p.c throughout this identical time. With a flat frequency pattern mixed with an rising severity pattern in recent times for industrial auto legal responsibility, this comparability calls out the upper inflation confronted by insurers past simply common inflation traits.

Private Auto Legal responsibility

Whereas alternative prices stay flat to damaging offering aid to non-public auto bodily harm, private auto legal responsibility represents roughly 60 p.c of the general private auto line. Just like industrial auto legal responsibility – however barely decrease – declare severity for private auto legal responsibility has elevated at a compound annual fee of 6.3 p.c from 2014 via 2023. Nonetheless, in contrast to industrial auto legal responsibility, the frequency for private auto legal responsibility has declined barely in 2022 and 2023, with 85 claims per $100 million GDP in 2023 in comparison with 90 in 2022 and 100 in 2021.

Limitation of trade information

The report depends on trade information as reported by insurers to the Nationwide Affiliation of Insurance coverage Carriers (NAIC) and made out there via totally different reporting suppliers, comparable to S&P International Market Intelligence. As such, totally different particular person inflationary parts – whether or not financial, social, or in any other case – can’t be decided utilizing the underlying actuarial methodologies.

Nonetheless, like prior research the majority of accelerating inflation earlier than 2020 is attributed to social inflation, whereas social inflation and financial inflation dominate rising inflation collectively starting in 2020.

Triple-I continues to foster a research-based dialog round social inflation as a part of authorized system abuse. For an summary of the subject and different useful sources about its potential influence on insurers, policyholders, and the economic system, try our information hub.